Condo Insurance in and around Riverside

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Your Search For Condo Insurance Ends With State Farm

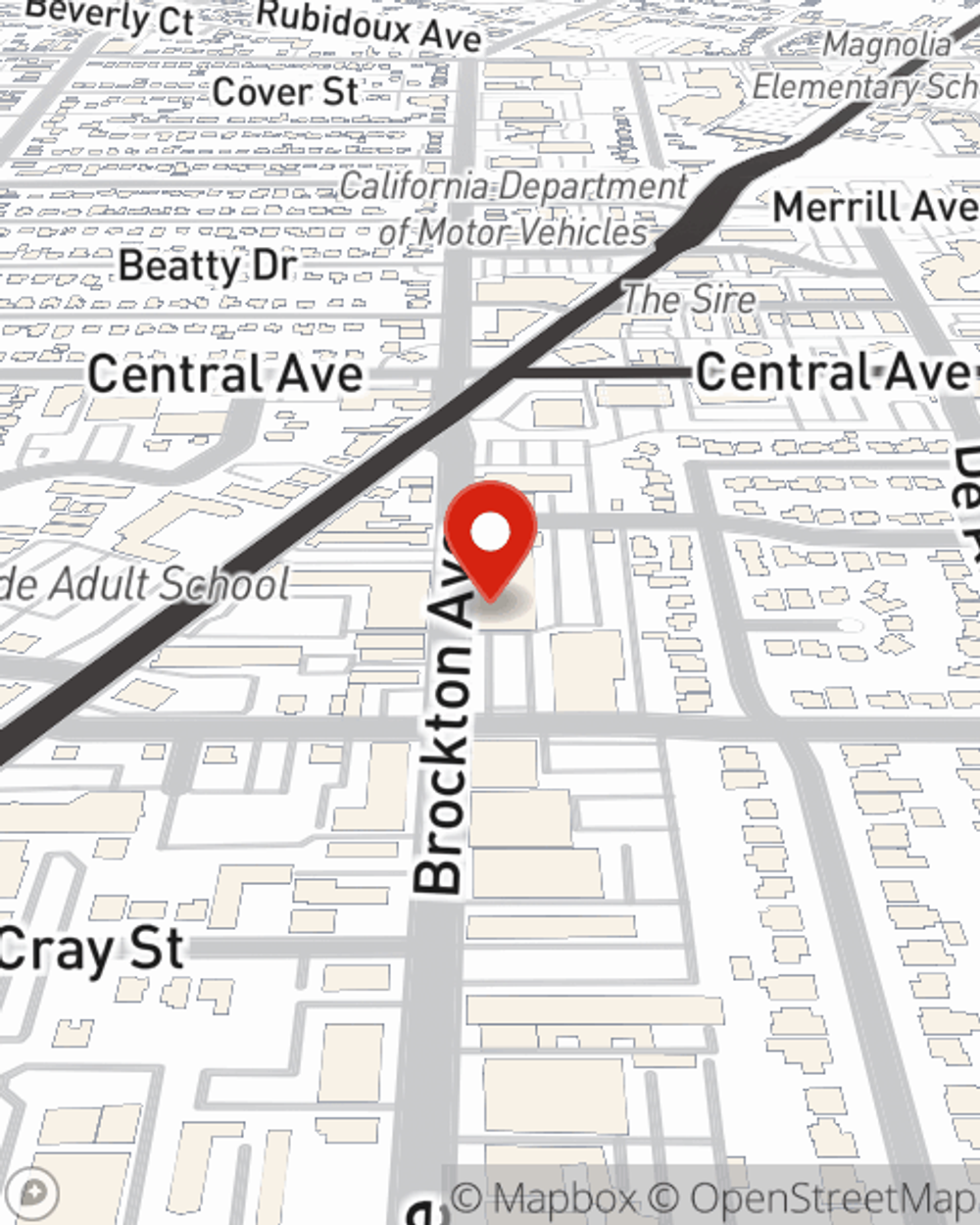

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Riverside. Sorting through providers and deductibles isn’t easy. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Riverside enjoy unbelievable value and hassle-free service by working with State Farm Agent Deborah Sanders. That’s because Deborah Sanders can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as furniture, tools, appliances, clothing, and more!

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Agent Deborah Sanders, At Your Service

Everyone knows having condominium unitowners insurance is essential in case of a ice storm, tornado or windstorm. Sufficient condo unitowners insurance can cover the cost of reconstruction, so you aren’t left with the bill for a home you can’t stay in. Another valuable component of condo unitowners insurance is its ability to protect you in certain legal situations. If someone hurts themselves in your home, you could be required to pay for their lost wages or the cost of their recovery. With the right condo coverage, you have liability protection in the event of a covered claim.

That’s why your friends and neighbors in Riverside turn to State Farm Agent Deborah Sanders. Deborah Sanders can explain your liabilities and help you select the smartest policy for you.

Have More Questions About Condo Unitowners Insurance?

Call Deborah at (951) 684-8822 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Deborah Sanders

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.